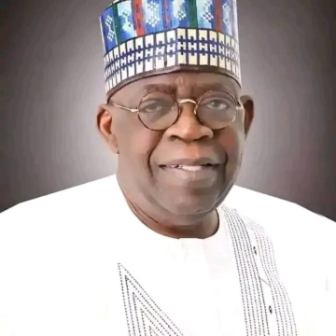

Nigeria can not fund itself, says Tinubu amid N77trn debt overhang

President Bola Tinubu has admitted Nigeria cannot fund itself due to its indebtedness and over-reliance on domestic and external borrowings.

Nigeria’s debt stock currently stands at N77trillion, as President Tinubu warned country would no longer rely on borrowing.

The President said this in his speech to add hoc tax reforms committee inaugurated on Tuesday.

“The consequences of the ongoing failure of our tax regime are real and significant. The inability of the government to efficiently raise revenue has led directly to an over-reliance on borrowing to finance public spending, ” he said.

Tinubu added: “A government that cannot properly fund itself will also lack the flexibility or fiscal scope to sensibly manage the economy or respond to external shocks.

“Instead, debt service begins to consume an ever greater portion of the government’s already meagre revenues.

“This traps the economy in a vicious cycle of borrowing simply to service previous debt and leaves almost no scope for socio-economic development.

“As President, I am determined to end this cycle. On the day of my inauguration, I promised that my administration would address all of the issues impeding investment and economic growth in Nigeria.”

TheCornet reports that data released by the Debt Management Service, DMO, shows that N19.64 trillion of debt stock are foreign loans while domestic borrowing account for N30.21 trillion.

Equally, the Central Bank of Nigeria loan intervention to the government, through its “Ways and Means’ policy, composes about N22.7 trillion of the total debt.

Much of Nigeria’s current earning goes into debt servicing, as the country splurged a whopping N3.36 trillion for the purpose in 2022.

Nigeria spends about 96.3 per cent of its revenue on debt servicing in 2022, the World Bank has said.

Tax to GDP is low, and there is the fear that increasing taxes would exercabate poverty in Nigeria’s fragile economy.

The economy is assailed by poor industrialisation, ineffective monetary policy, a bloated and expensive governmental system, corruption, running inflation, dwindling consumer purchasing power, and rising unemployment.